Introduction

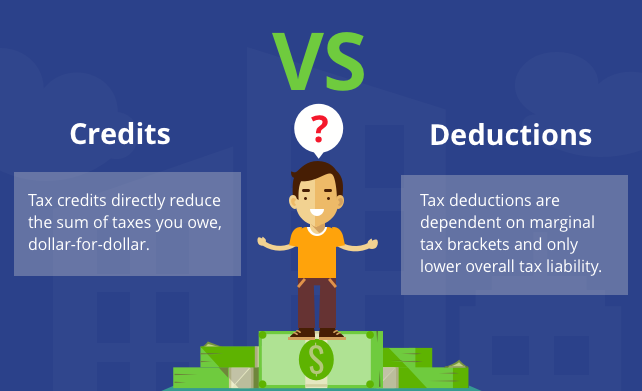

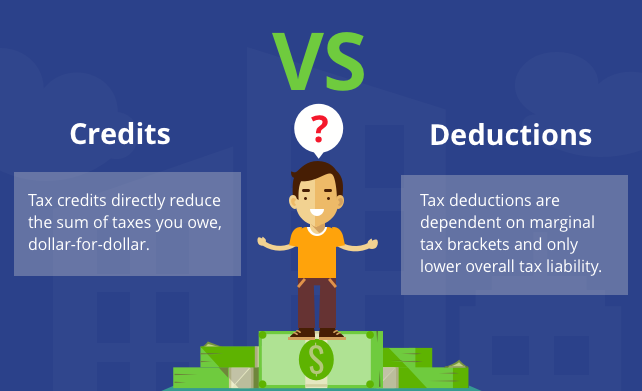

You can reduce your tax liability in several ways. However, tax credits and deductions are likely to be the most utilized. While superficially similar, these are, in fact, two different systems. Understanding the difference between tax credits and deductions is essential, as credits reduce your tax liability while deductions reduce your taxable income. But both can help you save money in the long run. But both can save you cash in the long run. Consult a financial expert if you need help with your tax preparation. Consult a financial planner for advice on how to minimize your tax liability.

To What Extent Can You Claim A Tax Credit?

Tax credits lower your tax liability by the same amount you claim, dollar for dollar. Individuals eligible for a $3,000 tax credit will have that amount subtracted from their taxable income. A tax credit can reduce your taxable income and sometimes even net you a refund. However, not all tax credits can be cashed out for their original value. Even while a nonrefundable tax credit can lower your tax liability to zero, you won't receive any further funds from the government if its value exceeds what you owe. There are two tax credits: those that can be refunded and those that cannot.

If the credit exceeds the amount of taxes owing, it is considered a refundable tax credit; otherwise, it is regarded as a nonrefundable tax credit. If you have a tax liability of $1,500 but are eligible for a $2,000 tax credit, you will owe no taxes. If you had a tax liability of $2,000 and were eligible for a $2,000 tax credit, your tax liability would be reduced to zero, and you would receive a check or electronic payment for the remaining $500. Each tax credit has its own set of instructions from the IRS that specify whether it is nonrefundable, refundable, or partially refundable.

What is Tax Deduction?

Your tax liability can be reduced by taking advantage of available tax deductions. A deduction won't reduce your taxes by the same amount as a credit would. Instead, your tax savings from a determination will be proportional to your income tax bracket. Surcharges are applied at different rates to different parts of your income based on where you fall within the tax brackets. As the tax rate increases with increasing income under the marginal tax system, higher-income earners stand to save more money thanks to deductions.

Standard And Itemized Deductions: Categories Of Tax Savings

Standard deductions and itemized deductions are the two main types of tax breaks. To avoid double taxation, taxpayers must select one of the two options below. The government establishes and periodically revises the amount of the standard deduction. Depending on your filing status and other factors, you may be able to subtract it from your gross income. 4 Itemizing deductions, such as those for charitable contributions and medical expenses, is an option if the standard deduction doesn't apply to your situation or if the total is more than the standard deduction. Form 1040's Schedule A is where you'll want to detail your itemized deductions.

To Take A Tax Credit Or A Tax Deduction: Which Is Better?

Due to their more direct impact, credits against taxes owed are preferred over deductions. Your marginal tax rate determines how a tax deduction reduces your tax bill. With a 10% tax rate, a $1,000 deduction would only result in a $100 reduction in your taxable income. Tax deductions vs credits are two ways to reduce your taxable income, but if you're qualified for both, doing the math will tell you which will save you the most.

Learn About Tax Deductions And Credits To Get The Most Out Of Your Money

You can lower your taxable income by taking advantage of tax deductions vs credits. The more you know about tax credits, beliefs, and their differences, the more money you can save. Remember that if you don't qualify for additional deductions, taking the standard deduction will still reduce your taxable income by a specific dollar amount, lowering your tax burden. Or, for some, itemizing can result in tax savings. Consultation with a tax accountant is helpful for those who are unfamiliar with tax law and want to make the most of their refund. Multiple no-cost tax software and services are available for filers of varying financial means.

Conclusion

There is a nuance between tax credits vs tax deductions in how they work to reduce your taxable income. A tax credit reduces your tax liability by the same amount you claim it. In contrast, a tax deduction reduces your taxable income and, thus, your tax liability to a lesser extent. Tax credits are often more beneficial because they reduce your taxable revenue by the same amount you paid. Deductions may not immediately lower your taxable income, but they still have value. Knowing the distinctions can help you save the most money on taxes, but if you want additional information, you should talk to a tax expert.