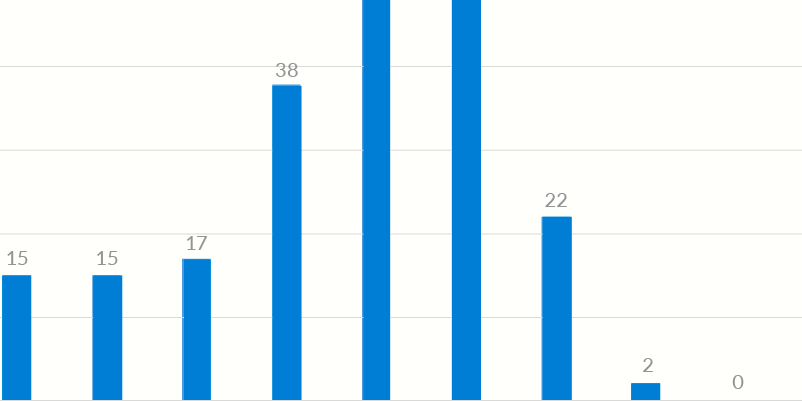

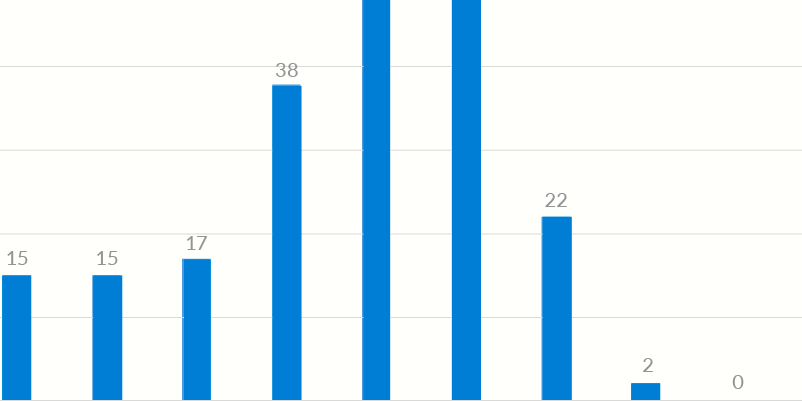

Europe's tax rates are highly diverse, from Finland's sky-high 59% to Hungary's deficient 9%.

No one should be surprised by Finland's tax rate because of the reputation Northern European countries have for not only having high tax rates but also providing generous social security benefits to their citizens. It is more difficult for countries with lower tax rates to provide tremendous social safety nets for their populations.

Understanding the European Tax Rate

First of all, we need to grasp what the European tax rate is. From 1996 to 2021, the average personal income tax rate throughout the European Union was 40.24%t. The highest point was reached in 1996 at 47%, and the lowest was called in 2011 at 36.6%.

However, if we look at each country in detail, we can see a significant divide between the governments of northern Europe and the Baltics. In 2022, Finland's Personal Income Tax rate of 56.95% was the second highest in the world, behind only Cote d'Ivoire's 60%. Taxes in Finland supposedly don't concern the Finns, as the nation has a progressive tax rate. This means the wealthiest are taxed considerably more than low-income and middle-class earners. Similarly, the legal system imposes heavier penalties on the affluent than on the general public.

Baltic States

It has been determined that Lithuania is an ideal place for new businesses to launch because of the conducive environment for generating new ideas and creating new products. Firms in this environment need to be adaptable, creative, and ready to make quick decisions because of the limited size of the market and the size of the network within which they operate.

Though there is a wide disparity between the wealth of different groups in Latvia, Lithuania, and Estonia, the three countries have been widely hailed as economic miracles since their independence from the Soviet Union.

Arctic Europe

Denmark and Norway, with their surprisingly low corporate tax rates (around 22%), are likely to be more appealing to firms than Western Europe. Even more enticing is the 20.6% corporation tax rate in Sweden. The country's top corporations are, however, all Swedish-owned. Volvo, H&''M, Ikea, and Electrolux are just a few examples of Swedish-owned firms that have remained faithful to their homeland despite the allure of foreign competitors.

Compared to China, Hong Kong, New Zealand, and Singapore, Denmark is regarded as one of the world's best countries to do business by the World Bank.

Southerly European Region

Both individual and corporate tax rates in Southern Europe are a mixed bag. For instance, Malta has been the target of numerous tax inquiries and criminal investigations in recent years despite its longstanding reputation as a "tax haven" due to its low tax rates for foreign corporations. Citizens face a progressive tax structure where the rate increases from 0% to 35% on all personal income.

Taxes in Spain are about average for European countries and are offset by generous social safety nets, including free healthcare for working inhabitants. Similarly, Italians have access to social safety nets and pay progressive tax rates based on income.

Conclusion

Europe's average corporate income tax rate is 21.9%, which is lower than the global average of 23.54% in 2021 compared to 180 different jurisdictions. Corporations can benefit significantly from being in European countries that offer lower tax rates: A recent estimate puts Apple's tax savings in Ireland at USD 15 billion.

However, corporation tax rates are falling globally; the average company tax rate fell from 32.6% in 2000 to 21.9% in 2017.

When Saldo connects to Inventi, he

As part of its state-of-the-art practices, Saldo Finance will process SEPA payments using Inventi's SEPA CT and SEPA Instant CT Connectors as well as the Submission of Regulatory Information via STI Connector to the Lithuanian State Tax Authority and the PLAIS Connector for integration with the Lithuanian Center of Registers.

How does one know if buying something makes them happy?

If you get a thrill from the thrill of the purchase—whether it be the thrill of opening a fancy box, the joy of cutting the tags off of brand new clothes, or the charge of an impulse buy because the price is too reasonable to pass up—try not to beat yourself up too much when the pangs of regret (also known as buyer's remorse) set in.

What are new approaches to satisfying customers being implemented by FinTech banks? Fintechs, a portmanteau of "financial" and "technology," has been causing a stir in the banking industry for over a decade. Even if it's a revolutionary concept, the idea behind it is straightforward: democratize banking by moving it online.