As a result, it can link transactions to the entity that issued the card used. BINs are encoded on various payment cards, including debit cards, credit cards, and charge cards. The American National Standards Institute (ANSI) and the International Organization for Standardization (ISO) collaborated to design a numbering system known as the bank identification number to identify financial institutions authorized to issue payment cards. The American National Standards Institute (ANSI) is a nonprofit organization (NPO) that develops business standards in the United States. In contrast, the International Organization for Standardization (ISO) is an international nongovernmental group that develops standards for various industries.

How Bank Identification Numbers (BINs) Work

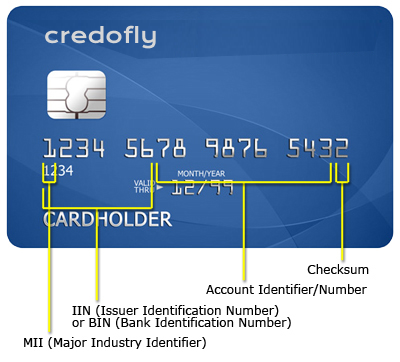

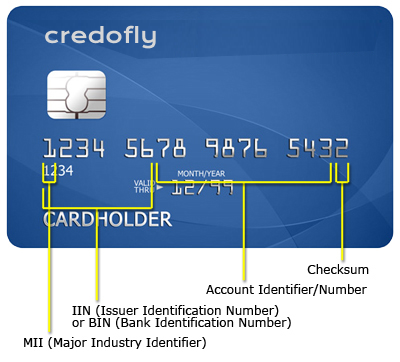

A BIN number is printed on the back of every payment card. This is a series of four to six digits arbitrarily issued to payment cards such as debit cards, credit cards, charge cards, gift cards, electronic benefit cards, and other payment cards. The number is printed right below where it is embossed on the face of the card, which also has the number. The first digit provides information about the primary identification for the industry. The subsequent numbers indicate the issuing financial institution or bank.

For instance, credit cards issued by Visa begin with the number four, classified as belonging to the banking and finance sector. Customers enter their credit card information on the page where they input their payment information while making an online purchase. After the consumer enters the card's first four to six numbers, the online merchant can determine which financial institution issued the customer's card. This includes but is not limited to the following institutions:

- The card brand is also known as the Major Industry Identifier; examples include Visa, MasterCard, American Express, and Diner's Club.

- The card level, such as corporate or platinum, for example.

- The category of card

- The nation that the issuing bank is located in

When a client begins processing a transaction, the card issuer gets an authorization request to determine whether or not the card and account are still active and whether or not the funds necessary for the purchase are accessible. Following completion of this procedure, the charge will either be accepted or rejected. The credit card processing system would be unable to trace the origin of the customer's money and hence would be unable to execute the transaction without a BIN. Merchants are granted the ability to process transactions more quickly and to accept a wider variety of payment methods when they have a BIN number.

What Are BINs Used for?

BINs may be put to work in a wide range of contexts. The major objective is to facilitate business owners' analysis and evaluation of payment card transactions. In addition, they make it possible for business owners to determine the issuing banks and whether they are located in the same nation as the device used to complete the transaction, as well as their addresses and phone numbers. Additionally, the customer's stated address is checked for accuracy. But more crucially, the numbering system helps detect identity theft or possible security breaches by comparing data such as the addresses of the issuing institution and the cardholder. This is done to determine whether or not there has been a breach. There are a few other names for bank identity numbers, but the issuer identification number (IINs) is the most frequent.

Benefits of a BIN

When paying with a debit or credit card, using BINs helps boost the checkout process's speed while maintaining its efficiency. When a consumer swipes their credit or debit card at a retail establishment, the BIN number on the client's card is read by the store's payment processor, verifying the customer's account with the card issuer. This is also how the authorization status of the transaction and its conformity with any applicable national regulations are determined.

Example of a Bank Identification Number (BIN)

The following is a made-up scenario that demonstrates how BINs function. Let's assume a consumer pays for their petrol using their bank card at the pump, filling up their tank. After swiping the card, the system will check the BIN to identify the particular establishment responsible for issuing the card.

Following that step, an authorization request is added to the client's account. Within a few seconds, the request is allowed, and the transaction is either accepted if sufficient money is in the account to pay the charge or denied if the client does not have sufficient cash to cover the charge. It is possible to determine which payment cards belong to a certain issuing financial institution using the bank identification number. In addition to this, however, they assist in the processing of financial transactions and work to safeguard customers from identity theft and other forms of fraud. Because of this, it is essential to maintain the privacy of all your financial information, including your BIN.